salt tax cap news

The cap on the SALT deduction started in 2018 because of the Tax Cuts and Jobs Act a tax reform passed in 2017. Trumps 2017 tax cut capped the previously unlimited SALT deduction at 10000 hurting taxpayers who itemize their deductions especially those in high-tax states.

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

According to the Tax Policy Center 16 of tax filers with income between 20000 and 50000 claimed the SALT deduction in 2017 compared to 76 for tax filers with income between 100000 and.

. Paying a state income tax of 10 percent or more. Sanders has previously floated about 400000 in annual income as the limit for unlimited SALT write-offs. In 2017 during the Trump Administration the Tax Cuts and Jobs Act TCJA raised the amount of the standard deduction.

As he said Monday about the repeal of the SALT cap If it doesnt happen I will look like an idiot. To help pay for that increase SALT deductions were capped at 10 000 per. Increasing the SALT cap and giving multimillionaires a 25000 per year tax cut.

The latest SALT plan would remove the current 10000 cap part of the 2017 tax overhaul entirely for those making less than 400000 a year. The so-called SALT tax cap imposed a 10000 limit on IRS deductions for state and local taxes like income and capital gains levies and property taxes. Unfortunately House Democrats just made a proposal that would compound the GOP tax bills regressiveness.

22-124 which modifies a previous law permitting pass-through businesses such as partnerships and S corporations to pay their state income taxes at the entity level as a workaround to the 10000 cap in the 2017 federal tax law. 1 day agoKey Points. 52 rows The deduction has a cap of 5000 if your filing status is married filing separately.

Not in these quarters. And while its presently due to sunset in 2025 Suozzi should. It wasnt until ten paragraphs into the report that NBC News acknowledges the SALT provisions would give two-thirds of people making more than a million dollars a tax cut Ina Coolbrith Park.

Republicans created the 10000 cap on SALT deductions as a means to offset the cost of their other tax cuts in the 2017 Tax Cuts and Jobs Act TCJA. Both Gottheimer and Suozzi have been some of the most vocal advocates for SALT playing a pivotal role in getting the language to increase the cap from 10000 to 80000 into the House-passed. The House-passed version of.

The SALT benefit was capped at 10000 in the 2017 Republican tax law and many Democrats come from areas where the average amount of tax paid far exceeds that limit. The SALT deal appeared to remove one obstacle to passing the sprawling 19 trillion spending plan. That was bad news for top earners in blue states such as California and New York.

Senator Bob Menendez a New Jersey Democrat who is also working on the proposal said the. The SALT deduction applies to property sales or income taxes already paid to state and local governments. At least hes trying.

Taxpayers can deduct up to 10000 of the state and local. Republicans established the 10000 cap on the SALT deduction in an effort to raise revenue to help offset the cost of tax cuts elsewhere in their 2017 law which reduced the corporate tax rate. The relaxed cap an increase from the current 10000 limit would last for a decade until 2031.

The Senate on Wednesday unanimously passed the SALT Parity Act SB. The lawmakers are urging colleagues to block. The TCJA reduced the corporate tax rate from.

Before the creation of a cap on this deduction 91 of the benefit of the SALT deduction. Five House Democrats are still fighting for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT. While the House package raises the SALT deduction limit to 80000 through 2030 negotiations are ongoing in the Senate with concerns over.

This cap remains unchanged for your 2021 taxes and it will remain the same in 2022 if Congress doesnt remove the cap in its spending bill. The provision in question would roll back the 10000 limit on the SALT deduction that was established by Republicans 2017 tax law signed by former President Trump. Colorados original law was effective for tax.

But the Tax Cuts and Jobs Act limited that deduction to 10000. The current Democrat-controlled House passed a bill in 2021 that would temporarily raise the cap to 80000 until 2031 when it would go back to 10000. The state and local tax deduction cap commonly known as SALT was enacted as part of President Donald Trumps 2017 tax reforms.

The deduction cap should be fully eliminated but Hill haggling may just raise it to a higher number say 15000 or 20000.

Solar Reserve Diagram Solar Power Plant Solar Generator Solar Power

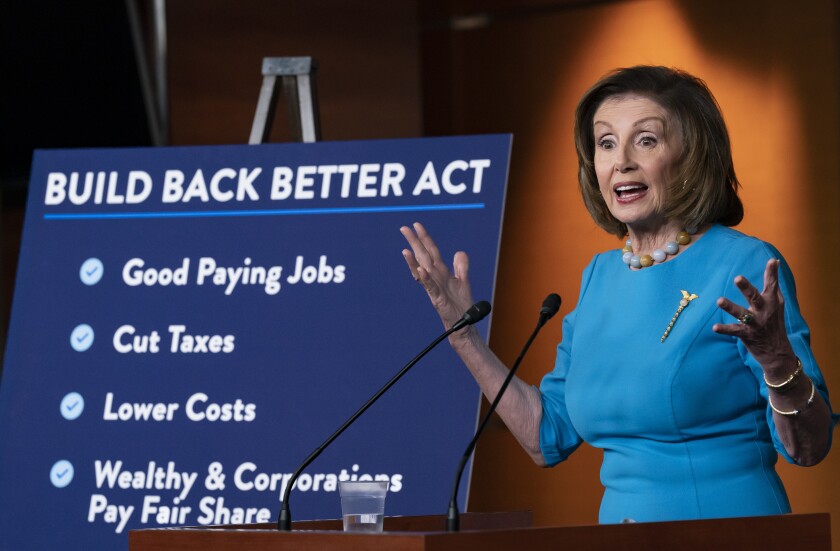

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

Calls To End Salt Deduction Cap Threaten Passage Of Biden S Tax Plan

Salt Deduction Biden S Spending Bill Why A Flat Tax Should Be Considered Steve Forbes Forbes Youtube

By Backing A Huge Tax Giveaway To The Rich Democrats Are Giving The Gop A Perfect Midterm Gift

This Bill Could Give You A 60 000 Tax Deduction

Salt Break Would Erase Most Of House S Tax Hikes For Top 1 Bloomberg

New Free Stock Photo Of Hand Pen Writing Tax Guide Inheritance Tax Tax Deductions

Build Back Better 2 0 Still Raises Taxes For High Income Households And Reduces Them For Others

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Repeal Trump S 1 7 Trillion Tax Cut Then Negotiate Salt Los Angeles Times

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

We Re No 51 Utah Last Again For Per Student Spending Tuition Vocational School Bloomberg Business

U S Rep Brad Schneider Named To Ways Means Vows Salt Deduction Battle Deduction Battle Vows

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

Two Thirds Of Millionaires Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

Most New York Times Matt Dorfman Design Illustration Illustration Design Newspaper Design Health Magazine Layout